A company can adjourn its upcoming Annual General Meeting of the members/ shareholders of the company after obtaining approval of the Registrar of Companies.

A company can adjourn its upcoming Annual General Meeting of the members/ shareholders of the company after obtaining approval of the Registrar of Companies.In accordance with the 3rd proviso of sub-section (1) of section 96 of the Companies Act, 2013, the Registrar may, for any special reason, extend the time within which any annual general meeting, other than the first annual general meeting, shall be held, by a period not exceeding three months.

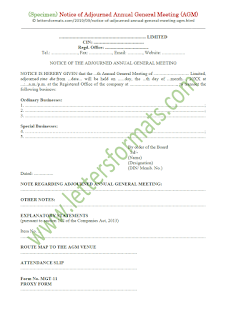

FORMAT

............................................................................ LIMITED

CIN: ............................................

CIN: ............................................

Regd. Office: ......................................

Tel.: ......................., Fax: ...................., Email: ............., Website: ....................

NOTICE OF THE ADJOURNED ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN that the ...th Annual General Meeting of ............................... Limited, adjourned sine die from ...date... will be held on ......day, the ...th day of ...month..., 20XX at ...:...a.m./p.m. at the Registered Office of the Company at ........................................., to transact the following business:

Ordinary Businesses:

1. ......................................................................................;

2. ......................................................................................;

3. .......................................................................................

Special Businesses:

4. ......................................................................................;

5. ......................................................................................;

By order of the Board

Sd/-

Sd/-

(Name)

(Designation)

(DIN/ Memb. No.)

Dated: .................

NOTE REGARDING ADJOURNED ANNUAL GENERAL MEETING:

............................................................................................................................

............................................................................................................................

............................................................................................................................

OTHER NOTES:

.................................................................................................................................

.................................................................................................................................

.................................................................................................................................

.................................................................................................................................

.................................................................................................................................

EXPLANATORY STATEMENTS

(pursuant to section 102 of the Companies Act, 2013)

Item No. ...

........................................................................................

........................................................................................

Item No. ...

........................................................................................

........................................................................................

By order of the Board of Director

Sd/-

(Name)

(Designation)

(DIN/ Memb. No.)

Dated: .................

........................................................................................

........................................................................................

Item No. ...

........................................................................................

........................................................................................

By order of the Board of Director

Sd/-

(Name)

(Designation)

(DIN/ Memb. No.)

Dated: .................

ROUTE MAP TO THE AGM VENUE

...................................................................

ATTENDANCE SLIP

...................................................................

Form No. MGT-11

PROXY FORM

...................................................................

Thanks For Sharing. Especia Associates In India has a dedicated team of Secretarial Services, legal professionals and Chartered Accountants who possess extensive experience in various corporate laws and commercial / legal documentation. Especia Can help you satisfy internal pressures so your teams can keep focused on the areas where they add the most value. Our focused and expert Company Secretarial Team offers a wide array of customized solutions to meet your various needs. if you need Company Secretarial Services call 9310165114 or visit us Secretarial Services

ReplyDeleteThanks for sharing this information. TDS return filing in Mumbai involves the accurate submission of financial information to the Income Tax Department in accordance with prescribed guidelines. This process serves as a means for the government to monitor and collect tax revenue from various sources of income, such as salary, rent, interest, and professional fees, ensuring that taxes are withheld at the source.

ReplyDelete