The bank may suo moto block a credit card issued to its customer if there is any violation of the terms and conditions or if there is any suspicious transactions detected in that card.

The customer may request for blocking or hotlisting the credit card to deactivate it because of several reasons viz. lost/misplaced the card, its stolen from him, unauthorised transactions carried out, etc.

Once the card is blocked or deactivated, the customer in his own discretion may request again for reactivation if he founds the lost card again or if he changes the PIN etc.

The application form for reactivation is available at the bank's website or branch office. Please find it and submit it. Otherwise if there is no prescribed form, submit a written letter. Following format should be enough. Do necessary modifications.

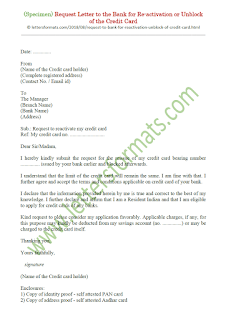

FORMAT

Date: ..............

From

(Name of the Credit card holder)

(Complete registered address)

(Contact No. / Email id)

To

The Manager

(Branch Name)

(Bank Name)

(Address)

Sub.: Request to reactivate my credit card

Ref: My credit card no. ...........................

Dear Sir/Madam,

I hereby kindly submit the request for the reissue of my credit card bearing number ............... issued by your bank earlier and blocked afterwards.

I understand that the limit of the credit card will remain the same. I am fine with that. I further agree and accept the terms and conditions applicable on credit card of your bank.

I declare that the information provided herein by me is true and correct to the best of my knowledge. I further declare and affirm that I am a Resident Indian and that I am eligible to apply for credit cards of any banks.

Kind request to please consider my application favorably. Applicable charges, if any, for this purpose may kindly be deducted from my savings account (no. ...............) or may be charged to the credit card itself.

Thanking you,

Yours faithfully,

signature

(Name of the Credit card holder)

Enclosures:

1) Copy of identity proof - self attested PAN card

2) Copy of address proof - self attested Aadhar card

No comments:

Post a Comment